We are constantly told that you cannot get a better return without taking on more risk, but the reverse doesn’t apparently apply.

Wanted: A better way to measure investment risk

About John

I'm a financial adviser/investor of 25 years, specialising in minimising the impact of black swan events. Black swan events such as the GFC can be devastating and very difficult to predict.

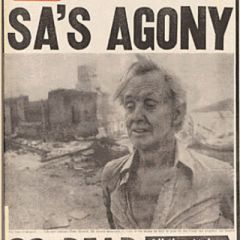

For retirees drawing on their funds, there are pitfalls to volatile investments. Picture: iStock

If you invest in higher-risk investments, it doesn’t follow that higher returns will necessarily eventuate. And here the argument becomes fairly circular – more risk means more risk, which may mean no return or total loss, if you get my drift.

The current way of measuring risk is to look at the average volatility of returns over an extended period (in practice, it is a bit more technical, but this is the essence of it). The more volatile the returns, the riskier the investment, and vice-versa.

This way of measuring risk has been around since the 1950s and it was certainly a big improvement on what went before.

However, the time has surely come for a new approach.

For people who are still accumulating funds, volatility is not so bad a measure, but far from perfect.

However, for that growing number of retirees who are drawing on their funds, there are a number of pitfalls.

Investment time horizon

Often, volatility is averaged over a time period of many decades, whereas retirees have a much shorter time period. They need some of the money now and more of it in an ongoing basis next year, the year after, and every year following.

Averaging volatility long term

The effect of averaging volatility over long periods can mask the effects of one or two years of awful returns.

For example, the GFC saw retiree account balances and lifestyles greatly reduced.

However, when the GFC comes to be averaged out over 20 or 30 years, it will disappear into an all-encompassing average. Despite its huge impact on those affected, it will almost disappear from the scene.

Much the same has already happened with the 1987 sharemarket crash.

Masking the differences

Averaging over long periods masks important differences between different periods of time. For example, people investing now must do so in a vastly different environment from that of the mid 1970s, until 2007.

Now, interest rates are at record lows and other investments, such as shares, provide a much better source of income.

From the mid-1970s until at least the early '90s, the reverse was true. Interest rates were at record highs (bond rates up to 16%), inflation was high but much lower than interest rates and interest-bearing investments produced excellent, real returns.

The message is simple. People must make real-world investment decisions in real time, and NOT in some mythical world represented by “long-term averages”.

The “long-term average world” may exist in Alice's Wonderland, but none of us live there.

Your rating