In a report by LF Economics this week, the writer highlights that Perth rents are falling faster than house prices at the moment. They write that WA's property market presents an intriguing case study of supply and demand.

More bad news for Perth property owners

About Jonathan

I am a real estate agent, trainer and father. I've tried to be the best I can in my career and as a father. Some days I do it well, others I fall short but I'm fully committed to living life to the fullest.

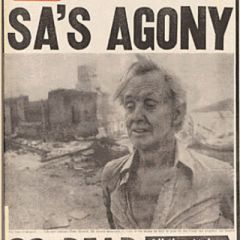

Many young homebuyers are already suffering reverse equikty of 12-17 percent. Picture: Supplied

They highlight that rental yields have been compressing over recent years, but not for the usual reasons of price growth. I'd like to highlight some factors that need fleshing out and, more importantly, need to be highlighted to anyone who has the capacity to do something about it.

Let's examine some possible causes of rental decline. Rent, like any commodity, is driven by supply and demand. Usually, if you have a dwindling demand then supply should follow suit. But the exact opposite is happening in Perth.

We have had a pro supply policy, not for investment properties, but rather for first-homebuyers - who make up a majority of the rental market - to buy their own home ahead of the normal gestation periods a young person may go through to reach this milestone.

This has resulted from the provision of grants for a new build. My question is simple, if you bring forward all of these peoples' life cycle of investment, then who is there to rent the property that they vacate when embarking on their ownership adventure?

The previous state government thought it wise to prop up one sector of the economy and, I would suggest, tackled this situation without putting in place measures to determine the impact.

The impact has been to create a glut of rental availability, dragging rents down.

But the further impact is that many of these young people get divorced or have relationship breakdowns. They hope to sell but can't, because the inflated demand drove the cost of the new home they bought to exceed its resale value.

These young couples are now in reverse equity of 12-17 percent, have no way of paying this figure out, and are faced with either a debt and no home, or renting their previous marital home out with the hope that the market may improve. All of this adds up to add more properties on the rental market.

Look deeper down the rabbit hole at the effect this policy has had on property values and it becomes a little more frightening.

Established property values have now declined, in some cases as much as 30%, which then means that developers are struggling to sell the product they have built without losing their pants. Their choice again is to rent out, further adding to the supply glut that is placing downward pressure on rents. This prompts investors to run for the hills and further diminishes already lacklustre demand.

There's another argument now about how this may affect the economy as a whole.

When you consider that most people's store of real and perceived wealth is in their property, what happens when they lose up to 30 percent of their real wealth?

1. Discretionary spending declines. If people are worried about their financial position, they won't spend and will start to save, instead. This affects the retail sector, meaning jobs decline and no jobs are created.

2. People in business would usually access their property value to either start a business or invest in the expansion of one. These people are unable to make these normal moves right now, therefore placing no upward pressure on the employment sector through jobs creation.

The time for handouts is over. I believe we need affirmative action in the following ways.

1. Abolish any form of build grant. This has been proven time and again to only serve in bringing demand forward, which ultimately creates a lag in demand down the track

2. Raise the threshold for stamp-duty relief for purchases for first-homebuyers to $600,000. This will encourage buyers back into the established market to correct some of the losses experienced by the previous policy. This is far more sustainable, as movement in the bottom end of the market will fuel movement in all sectors, increasing stamp-duty revenue.

If you think this makes sense, then let's get this happening!

Your rating